The quotes of the pair have sharply reversed the trend, and you cannot cancel the order? In most cases, this will result in serious losses. But such a simple mechanism as stop loss will help to minimize financial losses. Let’s see what it is and how to use it.

Take Profit and Stop Loss – what’s the difference and how to apply it

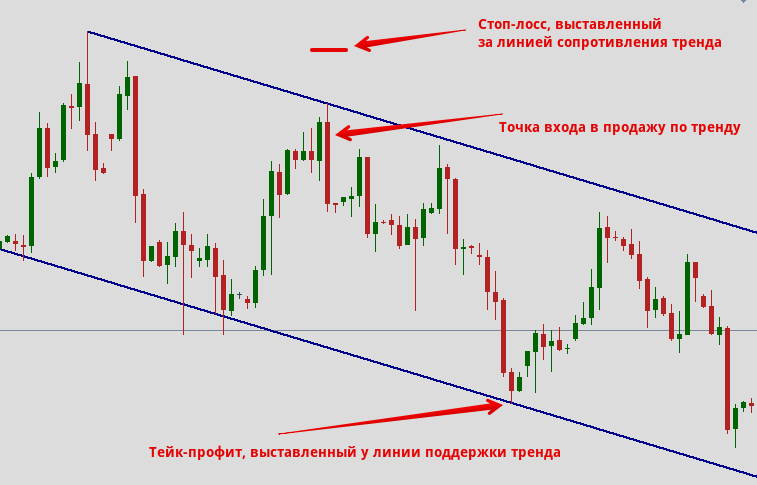

In the process of trading, a trader can make both direct and deferred trades, which are performed automatically when certain conditions are reached. The simplest variation of such orders is Take Profit and Stop Loss. The first term implies a condition under which it is necessary to close the position and fix the profit. The take profit is calculated from the position of the stop loss and, as a rule, is 150-250 points away from it.This is why it is very important for a novice trader to understand how to set a stop loss and in which situations it is appropriate to do so. Let’s consider an example.The current value of EUR/USD is 1.1276. There is reason to believe that there will be an uptrend in the near future, but there may be some volatility.To avoid disrupting the deal, you can set the stop loss at 1.1226, in which case, if the deal goes at a loss-making rate, you will lose only 50 pips, even if as a result of a fall in the rate will fall significantly lower.The photo below shows how the strategy works on a declining trend:

Small stop-losses are only allowed on daytime and shorter timeframes. If a large deal is planned with a waiting time of a week, the broker can set a requirement to set a stop loss of at least 300-400 points. This, in turn, can lead to quite large losses. So it’s not always appropriate to use stop-losses. Some experts advise to reduce the amount of the transaction in such a situation in order to level the risks, but in fact it will also reduce the profit.

How to set the stop loss and take profit for Metatrader 4

What’s a stop loss we’ve sorted out, we suggest you read the tips of experienced traders on how to use this tool. And let’s start with a level where it’s appropriate to put this limiter:1. Study the chart within the timeframe in which you work and compare it with the daily chart.2. Find the maximum for the day and on the current timeframe.3. Do the same for the peak value and calculate how many points the difference between them is.4. If the volatility is within 100 pt, there is no point in opening a deal. Most likely there will be slippage of stop loss, as a result of which the trade will still be closed, but at a level which is much lower than the set limit.5. With a good volatility of 200-300 pt or more, you can count on a good margin and get a range of movement, so the stop loss will work in time.6. If the deal is justified, open the stop loss at 50-80 pt. below the shadow of the candlestick with a minimum value. Go up 180-200 pt and set the Take Profit.The described mode, as a rule, does not contradict the policy of most brokers and is not subject to additional payments or commissions. Remember, with a stop-loss below 50 pips, slippage is common, and you may miss out because of temporary volatility.We will find out how to set the stop loss in Metatrader 4. The terminal allows you to use an extended version of the order, called a trailing stop. The mechanism assumes that as the value of the asset grows, the stop loss. will also change automaticallyExample, EUR/USD – costs 1.302, stop loss is set at 1.252. The trend continues to rise and the price of the pair increases to 1,310, in which case the stop loss will also rise to 1,260. It’s not difficult to calculate that when growing by 50 pips from the initial value, the trader completely covers the risk of losing funds.Regionally use stop loss and you will see that losses from unsuccessful transactions will decrease significantly and revenues will become more stable and even.