Traders have the option to choose a time frame to earn money in the market. Most of them trade inside the day and use small TFs for this purpose. But I recommend paying attention to older periods as well. Trading on them allows you to get a good income with less time to analyze the market and maintain trading positions. In this article I want to talk about W1. Day timeframe is mainly used by large market participants whose trades affect asset price movement. But investors like us can also earn on the weekly chart. However, it has some features. You need to know about them to increase the efficiency of trading on W1. I also recommend indicators that can be useful for trading on a weekly chart.

Trading functions on W1 1

I would like to highlight the three main features of the weekly time frame. Long-term and steady trend movements arise on this TF. The chart is easy to use for technical analysis because market noises are completely excluded. Trading in such trades is not enough. But the likelihood that they will be closed at a profit is high. The weekly time frame allows you to predict with great accuracy the further movement of the price. Candle analysis is the most effective among the methods of technical analysis.

Weekly Trading Guidelines

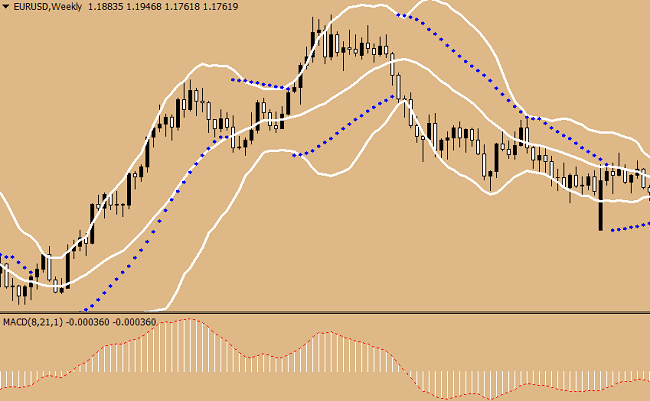

To achieve maximum results, no more than three candle patterns must be used in the analysis. Market entry is the result of so-called ‘value zones’. This is the area located between two moving averages with different periods. Trading is recommended for trend. It is also allowed to open trade orders in relation to the prevailing trend (as part of the correction). However, this can be done if the risk mitigation rules are strictly enforced. The size of such transactions should be small. After the price has passed towards the 8-10 candle deal, you need to either close the order or pull up the stop-loss.

Trading indicators on W1 1

Entry points must be searched within a smaller time period. In the future, the market situation is tracked on the weekly chart. Standard, proven indicators are quite suitable for market analysis. For example, you can set bollinger bands in a chart. With their help, you can identify the direction of the trend, determine the range of price movement, as well as the size of the possible correction. Set and then move stop-loss can be using such a popular indicator as parabolic. However, before you can use it to trade on W1, you need to make changes to your settings. The step should be 0.08 and the maximum value is 0.1. The MacD indicator will also be useful during TF week. It helps not only to track the direction of the trend, but also its strength. Divergence may signal the end of the current trend. I recommend paying attention week timeframe. Earnings on it are not fast, but the probability of a profitable transaction is very high. Inga Fedorova 25.03.2021 Record Weekly Timeframe. Features of trade. Forex | The magazine first appeared on forex-for-you.ru.