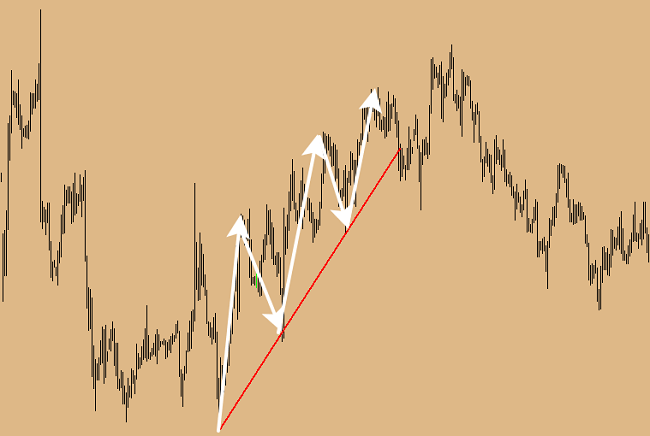

In technical analysis, there are basic candlestick models that work well, work well, and will work. But, unfortunately, novice traders do not always know about them. And traders who already have some experience in trading forget about such important analysis tools. Today I want to tell you about one of them – pattern of three Indians.If we see in the chart that

the price touched three times and fought off the trendline, which means that we

we have a pattern of three Indians.Look at the example:

To track the appearance of this candlestick model,

you need to draw a line through the last two extrema (minimum or maximum) and observe,

what happens next. If the price touches this line for the third time, then you can

make a decision on opening a trade deal in the direction of rebound.But to improve the quality of trading, I recommend that you do it with a confirmation of the signal. This may be an indicator, an additional important level, or the formation of a reversal model at the third touch.

Recommendations on the use of the pattern

Model three Indians works well on medium timeframes:

a sentry and a 4 o’clock. If it appears on other TFs, it will require more

serious signal confirmations. Nelsya to open an order immediately after the third touch. You have to.

make sure the signal is complete.Don’t build your trading strategy on this alone

pattern. First of all, it doesn’t appear on the chart often. And second of all, the third

Touching does not guarantee that the price will continue to move in the direction of rebound. In any case.

in the case of filters. I recommend using Price patterns to confirm signals

Action. Their education at the third touch of a button is, in most cases, completed

a profitable trade. Don’t go after the number of transactions. It’s not uncommon for newcomers to make such a mistake. They’re starting to see the signals where they’re not. It is better to make only a few profitable deals than to open a huge number of trading orders, most of which will be unprofitable. To start looking for a pattern on the history. Don’t spare any time for that. The analysis of historical data allows to get skills on fast identification of this candlestick model. After that it is necessary to confirm the obtained knowledge in demo trading. And then the trader will be able to use the pattern of three Indians in real trading quickly and efficiently. Fyodorov’s Inga23.04.2019