I want to continue with this article on the subject of Techanalysis by telling you about a combination of candlesticks called the Dragon Pattern. It resembles the double-bottomed candlestick analysis figure, but has its own peculiarities. Pattern the Dragon can be seen on the price chart on a downtrend. It indicates a possible reversal in the direction of movement from bearish to bullish. On an upward trend, a reverse pattern may form, which is a harbinger of a change in the direction of the market from bullish to bearish.

How the Dragon pattern is formed

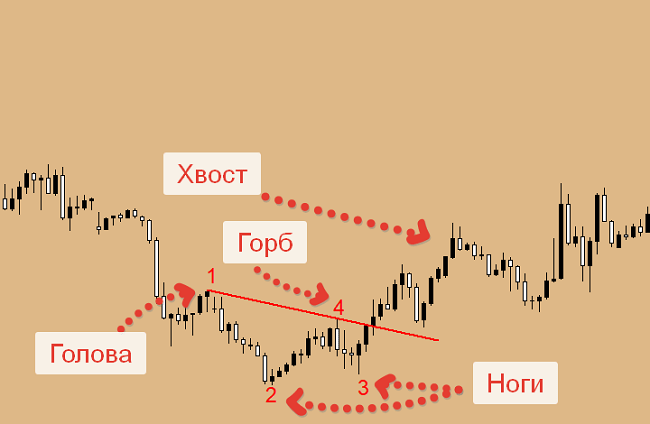

This candlestick figure is built

on four points. We’re looking for the dragon’s head first. In the bear market, she is

local maximum, which is formed by the results of correction upwards. It’s, uh… it’s, uh…

point one. Then two legs should appear – points 2 and 3. It’s nothing but

two local lows, which are formed on the continuation of the downward movement. Between…

They’re the hump of a dragon. That’s point four. We draw a trend line through points 1 and 4.

Its intersection upwards (closing the candlestick above this line) is the beginning

the formation of a figure’s tail and a point to open a Buy position. I want to draw your attention

for some important moments. Pattern Dragon should have about one leg

length. That is, the lows that make up these parts of the figure must be

on the same level. Well, of course, that’s ideal. In practice, this is very common

seldom. The difference between the length of the legs can be within 10 percent.Also you need to convert

attention to the height of the hump. It should be 40-50% head height.And now let’s take a look at an example of Dragon shape formation:

Take Profit and Stop Loss

So we are the entry point into the market

we already know. You have to open a BUY order after

of closing the candlestick above the line drawn through points 1 and 4. Now I’m gonna tell you,

how to limit losses and lock in profits.Stop-loss is set below the leg level. However, it is recommended to fix the profit in parts. The tail is a potential profit. Part of the deal can be closed at take profit when the price reaches the head level. The remaining part of the order should be transferred to a lossless position and closed, based on how the market situation will develop. You can use trailing stop or other indicator readings.Pattern The Dragon on an uptrend is formed according to the same scheme, but with the corresponding corrections.In conclusion, I would like to say that it will not be possible to trade only on this candlestick figure, because it appears on the chart rarely. But you need to know about the Dragon so you can use that pattern to make a profit.Fyodorov’s Inga27.05.2019